Sprinting the last mile with WTTx

WTTx is a new approach for solving the old last mile problem. Using WTTx avoids trenching and wiring, yielding quicker time to market, faster user growth rate, and shorter payback period.

By Wu Shengfei

According to the State of Broadband 2015 report issued by the ITU and UNESCO, broadband connectivity is an important economic growth enabler that ordinary people should be able to afford.

ITU data shows that 4.2 billion people lack Internet access. For the 3 billion connected, basic broadband services no longer meet requirements, hence the slew of national broadband plans being implemented across the planet.

Whether the objective is connecting the unconnected or boosting speed, the last mile problem for broadband networks persists. With the rapid development of wireless tech and fiber optic taking over from copper, a new approach is necessary.

WTTx covers the gap

Ovum states that the number of global 4G users crossed the 1 billion mark in 2015, with strong double-digit growth to reach this number in just six years. But, will this trend continue over the next five?

If 4G is used to provide the last mile of broadband, a landmark turning point will have been reached. If 4G, 4.5G, and 5G apply to fixed broadband scenarios as WTTx, can they provide a wireless access solution to rival the FTTx experience?

WTTx: As fast as fiber

Benefiting from 4G and 4.5G, peak rates from WTTx keep jumping. New tech like 4x4 MIMO, 256QAM, FDD+TDD CA, Massive CA, and Massive MIMO require only 40 to 60 MHz of spectrum to enable gigabit cell peak rates, so better home broadband can arise from WTTx based on 4.5G.

The jump in single user peak rates – from 150 Mbps (UE CAT 4) to 600 Mbps (UE CAT 12) and then to 1 Gbps (UE CAT 16) – means WTTx surpasses copper and matches fiber optic in terms of experience. More importantly, improving cell capacity can solve direct restraints on capacity growth; for example, supporting up to 100 MHz spectrum can increase cell capacity. Using Massive MIMO to achieve spatial multiplexing for large numbers of users increases cell capacity fivefold, so operators can carry more WTTx users and boost single user rates.

WTTx: Same services

TV has moved on from a device that receives broadcasts to one that provides video on demand. How can Internet video be delivered to millions of households cost-effectively? WTTx, which can bear IPTV, can deliver TV shows, Internet video, and web browsing. Its multifunctional design is also affordable for most households.

Other than video, VoIP over WTTx is a mature service that can provide triple-play ─ data, video, and voice ─ over WTTx as easily as fixed-line broadband can.

Sharing resources

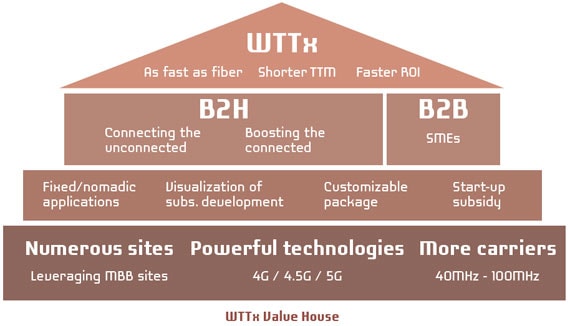

WTTx quickly provides high-quality services with fast ROI, while FTTx is known for its stability and reliability. Thus, the two are complementary. In areas that need broadband, a WTTx solution can explore the potential of the business-to-household (B2H) and B2B markets. Once a certain user base has been developed, fiber optic can be rolled out according to demand, enabling targeted FTTx construction.

WTTx and MBB are both based on 4G/4.5G technology. WTTx serves households, while MBB serves individuals. Both can, to a certain extent, share network resources. When fiber optic is extended to areas that have WTTx coverage, WTTx network resources can be released to meet the surging demand in MBB traffic.

Two types of resources can be shared between WTTx and MBB: site resources and carrier resources. When MBB loads are light, individual MBB users and household WTTx users can share the same carrier without obvious conflict in resource demand. When loads are heavy, WTTx and MBB typically use different frequency bands or carriers to avoid demand conflicts. For example, WTTx uses 2.3 GHz, 2.6 GHz, and 3.5 GHz, which offer large bandwidth and are efficient and inexpensive. MBB uses frequency bands such as 1.8 GHz and 800 MHz, which often carry massive amounts of mobile users but have comparatively limited resources. Guaranteeing mobile user experience is necessary so that main income streams are not affected.

WTTx creates a new B2H blue ocean market

Mobile operators' focus on B2C, with SIM cards sitting at the core of their service models from 2G to today’s 4G. Over the past 20 or so years, operators have introduced some B2B services, the majority of which are bundled sales of simple service combinations on a B2C basis. B2H is a good direction for operators seeking to move beyond B2C.

Little competition exists in the fixed-line broadband market for households, the APRU of which is between six and eight times higher than mobile APRU. It’s thus a blue ocean of income for mobile operators, with WTTx as the best vessel for sailing into the future.

WTTx for the home

Typically low-churn, B2H services include family plans with shared data and bundled fixed-broadband and mobile services. Mobile operators can provide these types of services on wireless networks, paving the way for smart homes.

Household broadband penetration with fixed-broadband is typically less than 20 percent in many developing countries, and much lower in populous countries like Indonesia, where it’s only 6.7 percent. Fixed line broadband is often not feasible: in many countries, copper infrastructure is terrible, and building FTTx is costly and hindered by private property rights and other restrictions.

In more developed countries where market leaders own copper and fiber resources, competitors cannot provide household broadband or profit from doing so due to high rental costs. The big players can also offer bundled packages with mobile, fixed-line broadband, and IPTV. Providing home broadband services via WTTx, therefore, can act as a powerful tool for smaller operators to take on the top-tier operators in developed countries and expand broadband coverage in developing countries

Searching for spectrum

Spectrum is the key to wireless networks. A 3G carrier uses 5 MHz, a 4G carrier 20 MHz, while a 5G carrier will use 100 MHz. Technology has boosted spectrum efficiency, but the market is calling for greater bandwidth. Because it’s for household and enterprise users, WTTx has a much larger demand for bandwidth than MBB, and so operators are looking in earnest for more spectrums to provide a better WTTx experience. For example, Saudi Arabia's largest operator STC has 50 MHz of spectrum in the 2.3 GHz band and 70 MHz of spectrum in the 3.5 GHz band. Sri Lanka's leading mobile operator, Dialog, has 75 MHz of spectrum in the 2.3 GHz band. In early 2016, Norway's number one and two ─Telenor and TeliaSonera ─ acquired 90 MHz and 100 MHz of spectrum in the 3.7 GHz band, which they plan to use to expand B2H and B2B services.

WTTx: The way to success

WTTx offers a low barrier for entry, fast service provisioning, and rapid profits. Assuming a certain amount of spectrum and site resources are available, recommendations for deployment are as follows:

Get scenario based

In some developing countries, governments stipulate that newly released BWA spectrum can only provide fixed broadband services, meaning that CPE can be locked to a certain cell to prevent roaming and thus meet regulatory requirements.

In developed countries, governments generally have policies of spectrum neutrality. In addition to providing fixed broadband applications, operators also support nomadic applications, which suits out-of-town trips ─ a common behavior in many countries.

Visualize for precise service rollout

WTTx is a wireless network, so it’s difficult to accurately predict which areas can grow users at what rate, which in turn impacts service rollout efficiency. Our mature coverage and capacity planning methods and experience can visualize user development, greatly increasing the success of WTTx.

Don't forget enterprises

Enterprise customers tend to generate high profits, often requiring VPN support alongside broadband to set up their own private networks over public networks.

Early subscriber subsidies

Like MBB, WTTx requires a certain scale of subscriber base to succeed, and early stage subsidies provide some necessary fuel.

WTTx drives universal broadband

WTTx has already been widely adopted around the world, and not just in large emerging markets. The simple implementation and economic viability of WTTx has greatly expanded the potential market size for operators and increased broadband penetration, bringing enormous socioeconomic benefits.

In China, for example, the Chinese government launched a National Broadband Strategy in 2013, and in 2014 the Ministry of Industry and Information Technology released a policy promoting rural broadband penetration. This generated a positive response in the nation’s central and western provinces, with Jilin Mobile growing broadband penetration by 300,000 rural households in the span of just a year.

In Saudi Arabia, where broadband development has been relatively slow, just 2 million households out of 5 million have fixed broadband access. To increase broadband penetration, the government released a wireless broadband plan in 2012. The two leading operators, STC and Mobily, constructed WTTx on 2.3 GHz and 2.6 GHz bands and, in three years, added 3 million subscribers. Alongside wired networks, universal broadband access had almost been achieved.

With the advent of the digital era, universal broadband is viewed as a basic human right in many countries. ITU figures show that 148 nations already have national broadband plans in place to promote universal broadband penetration.

The success of WTTx around the world shows how this new approach is an effective way to solve the last mile problem. Through combining wired and wireless, universal broadband is becoming more feasible, opening up a new blue ocean market for operators and, ultimately, connecting the unconnected.